As we approach the new year, we would like to take a moment to thank you for your continued support of Fort Point Capital, and share a recap of our activities from 2021. We look forward to continuing our work together, and hope that 2022 is another successful year for all of us.

Forming New Partnerships

CellSite Solutions: Based in Cedar Rapids, Iowa, CellSite is an industry leading provider of telecom infrastructure asset refurbishment and related services. The Company’s offerings include custom modification and refurbishment of telecom shelters and equipment installation, as well as other maintenance and repair services. The Company will continue to be led by Carter Kramer and Chris Wiese, who co-founded CellSite in 2010.

Strata Information Group ( “SIG”): Based in San Diego, California, SIG is a best-in-class provider of IT services to higher education institutions. The Company offers a range of services including software implementation, cloud migration, digital transformation, database administration and ongoing support services. The Company will continue to be led by Henry Eimstad and Frank Vaskelis, who co-founded SIG in 1987.

Joining Forces

Our Portfolio companies continued their growth via acquisitions.

Sullivans completed the acquisition of Woodstock Chimes (“Woodstock”), one of the largest distributors of windchimes and musically tuned gift products in the United States, with over 900 SKUs sold online and in national and local retailers.

Barrington Media Group (“BMG”) completed the acquisition of Five Mill, a digital marketing agency and industry leader in enterprise-level search engine marketing (“SEM”) and social media marketing solutions. Founded in 2008 by Dan Soha, Five Mill utilizes extensive digital expertise as well as best-in-class proprietary, AI-driven bidding technology to optimize each client’s SEM goals.

EventLink is a provider of experiential marketing services and has built a reputation for creating/executing some of the most logistically challenging marketing events in North America. EventLink is actively seeking opportunities to partner with leading experiential and related digital marketing firms serving automotive, healthcare, technology, retail and other industries.

Capitalizing on our Efforts

We entered into a definitive agreement to sell our vertical transportation platform 3Phase Elevator to Berkshire Partners. Our team sourced and completed six add-on acquisitions supporting the vision of building the largest independent elevator and escalator company in the United States. 3Phase signed two additional letters of intent to acquire elevator companies during the sale process. 3Phase Elevator is another example of our commitment to investing in business-to-business services and the facilities services sector.

Growing our Team

Justin Shin has joined our firm as Director of Business Development. As Director, Justin will be primarily responsible for sourcing new platform investment opportunities, developing and managing relationships with new and existing sources of deal flow, and directing strategic marketing efforts.

Raising Additional Capital

We completed fundraising for FPC Small Cap Fund II (“Fund II”). Our Fund strategy will remain consistent with what has driven our success to date, continuing to partner with excellent management teams and entrepreneurs to build market-leading business-to-business services companies. Since the firm’s inception in 2010, we have raised close to $300 million in equity commitments across various investing entities and have invested in 12 platform companies and 19 add-on acquisitions. FPC Small Cap Fund II, with $194 million of commitments, exceeded its target of $175 million.

Investment Criteria

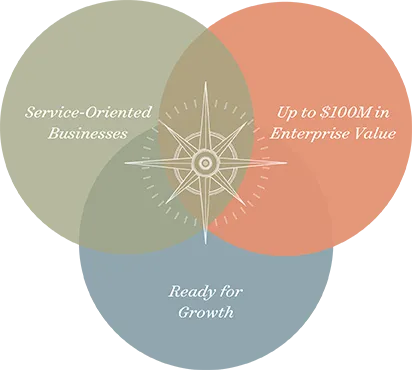

We look to partner with successful companies where the addition of our capital and operational expertise can accelerate growth opportunities.

Transaction Profile

- Control Buyouts and Add-ons

- $20-$100 Million in Enterprise Value

- $10-$40 Million in Equity

Service-Oriented Business Model

- Business Services

- Information & Software

- Media & Marketing

- Transportation & Logistics

- Industrial & Engineering

- Healthcare Services

Company Attributes

- Service-oriented Business Models

- Niche Market Leader

- Strong Customer Loyalty

- Growth-oriented

- High Margins

- Stable Earnings Base

We are actively investing our second Fund in service-oriented companies across a broad range of sectors. We invite you to speak with us and discuss potential acquisition opportunities.