See how we have helped current portfolio expand beyond their most ambitious goals.

Opportunity and achievement.

As we start the new year, we would like to take a moment to thank you for your continued support of Fort Point Capital. Despite the challenging market conditions, it was another strong year of deal activity and growth for Fort Point. We look forward to continuing our work together, and as always, we remain committed to partnering with promising founder-, family- and management-led service-oriented businesses in the lower middle market.

Wishing you much success in the year ahead!

Capitalizing on Our Efforts

FPC successfully concluded two relationships in 2025.

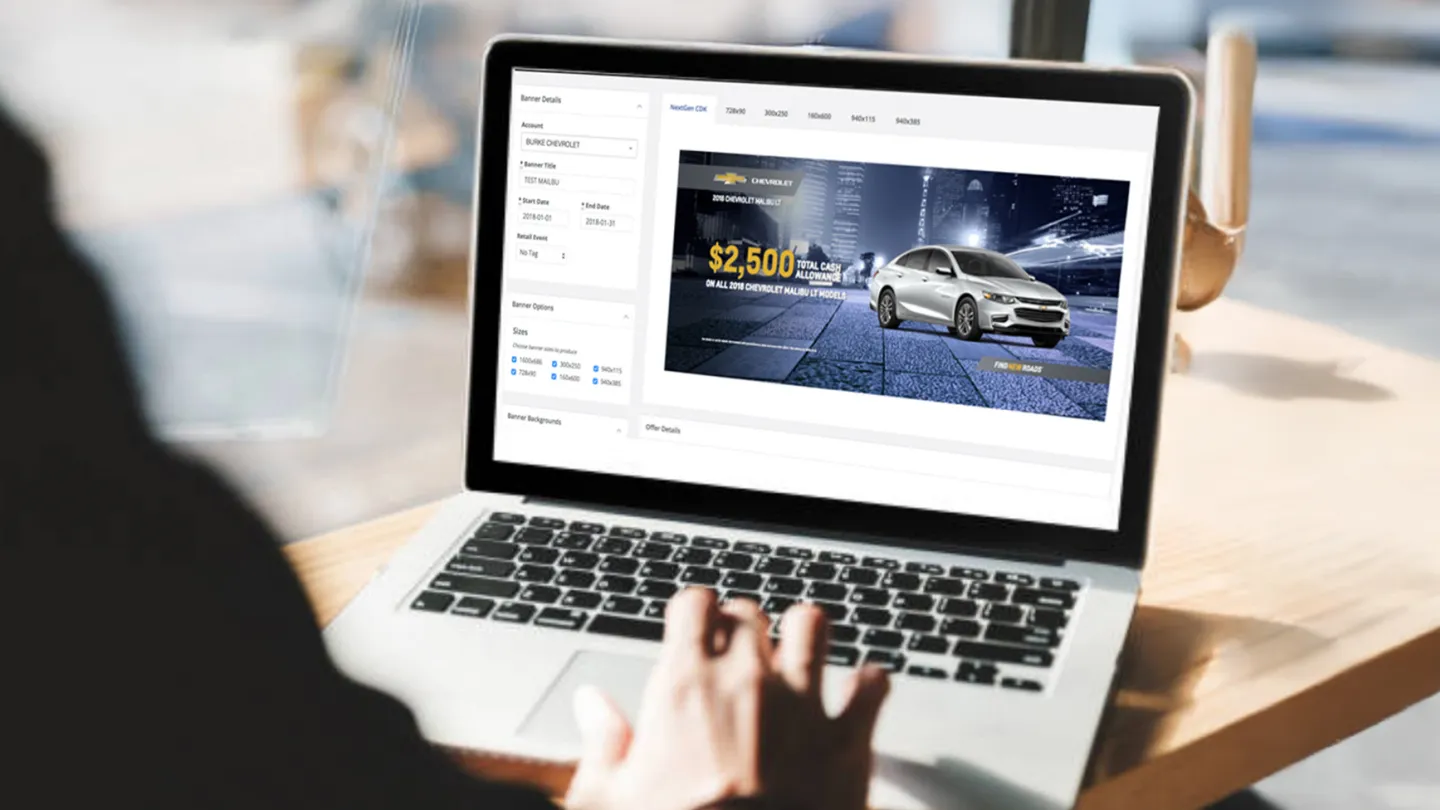

EventLink

Headquarters: Sterling Heights, MI

Sector: Marketing Services

Fort Point Capital successfully completed the sale of its investment in EventLink Holding Company to Serata Capital Partners and Paceline Equity Partners. Under FPC’s ownership, EventLink more than doubled its customer base while driving deeper penetration with marquee brand and agency partners.

Jones Lake Management

Headquarters: Cincinnati, OH

Sector: Business Services

Fort Point Capital successfully completed the sale of its investment in Jones Lake Management to funds managed by Leonard Green & Partners, L.P. FPC provided M&A support, enabling Jones to complete 15 strategic acquisitions over the past three years.

Supercharging the Growth

Two FPC portfolio companies significantly enhanced their capabilities through add-on acquisitions this year.

Jones Lake Management completed 5 add-on acquisitions

VisuSewer completed 2 add-on acquisitions

Seeking New Opportunities

With our new platform launches, we are actively seeking attractive opportunities in the following areas:

Digital Logistics

Companies providing specialized consulting and/or IT services to warehousing and/or transportation operations, often in partnership with leading software players.

Civil Engineering Services

Firms providing services that support critical infrastructure needs, including transportation, water resources and energy/grid connectivity.

Title Insurance

Commercial and residential title insurance agencies delivering best-in-class services across product lines, geographies, partner agencies and carriers.

Material Handling Equipment Services

Companies providing mission-critical, nondeferrable services for essential industrial supply chain functions.

Mobile Fleet Services

Providers of specialized mobile service centers that improve fleet safety and reliably while reducing downtime and overall costs.

Building Our

Leadership

Three FPC portfolio brands appointed new leadership in 2025, reflecting the drive to create new value.

Ice House America appointed Mike Strachan as CEO

NewBold appointed Johan Claassen as CEO

A Stronger FPC Team

Through new hires, the FPC team became stronger and better positioned for future success.

New Additions

Andrew Les

Vice President

Marile Marzo

Associate

Tom DePoalo

Assistant Controller

Chre Teitelbaum

Vice President of Data Engineering

Investment

Criteria for Success

FPC is a growth-focused private equity firm that helps family- and founder-owned, service companies accelerate their evolution and growth.

Transaction Profile

- Up to $125M in EV

- Up to $50M in Equity

- Control Buyout and Add-ons

- Family/Founder-Owned

- Management Buyouts

- Recapitalizations

Industry Focus

- Business Services

- IT Services & Software

- Field & Route-based Services

- Transportation & Logistics

- Marketing & Media Services

- Industrial, Testing & Engineering

- Value-Added Distribution

Characteristics

- Strong management team

- Fierce customer loyalty

- High margins

- Stable earnings

- Robust cash flow

- Identifiable avenues for growth

Our Portfolio

See our historical portfolio of completed projects with past investment partners.